Mortgage Rates Could Continue To Ease in 2026

- WWH

- 14 minutes ago

- 1 min read

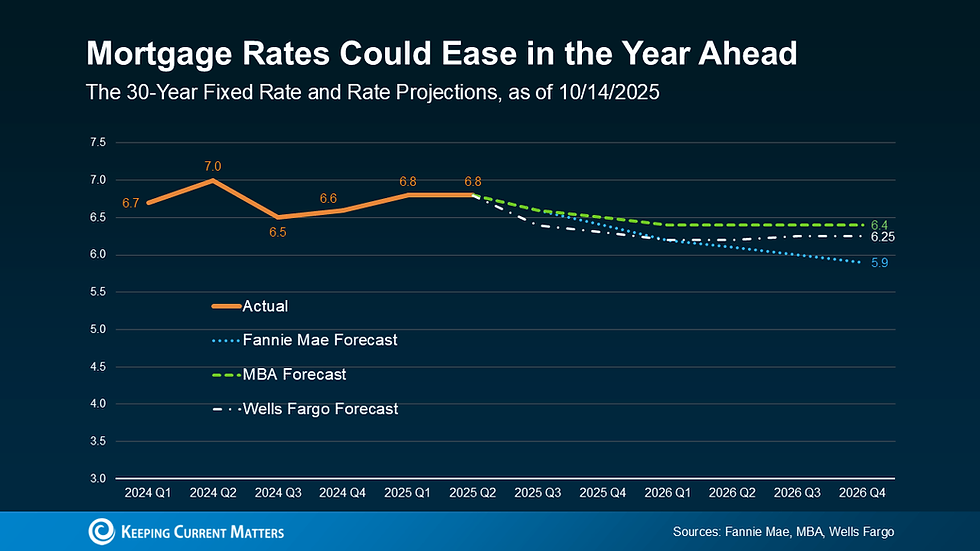

The number one thing most buyers have been waiting for is lower mortgage rates. After peaking near 7% earlier this year, rates have finally started to ease—and the latest expert forecasts suggest that trend could continue through 2026.

A Gradual, Not Instant, Decline

It’s important to remember that mortgage rates rarely move in a straight line. As the saying goes, “When rates go up, they take the escalator—but when they come down, they take the stairs.”

That means the path forward will likely be slow and uneven. Expect modest improvements throughout the year, with occasional bumps as new economic data and inflation reports come out.

What Experts Expect

Forecasts indicate rates could reach the low 6% range, and possibly even the high 5s by the end of 2026. While that may not sound like a dramatic shift, even a small dip can make a meaningful difference in affordability.

Why Even Small Changes Matter

You don’t need a massive drop to feel the impact. The difference between a 7% rate and a 6% rate could save hundreds of dollars a month on a typical mortgage payment—money that adds up quickly over time.

For many buyers who’ve been on the sidelines, this easing trend may finally create the opportunity to make a move.

Mortgage rates are expected to continue easing, though the journey will be gradual and occasionally unpredictable. Stay focused on the overall trend—not the week-to-week fluctuations—and you’ll be better prepared to take advantage of improved affordability when the right opportunity comes along.

Comments