Foreclosure Headlines Are Rising - Here’s Why the Housing Market Isn’t in Trouble

- WWH

- 3 days ago

- 2 min read

If you’ve seen recent headlines claiming foreclosure activity has increased for 10 straight months, it’s understandable to feel uneasy. On the surface, that kind of news can sound like a warning sign for the housing market.

But when you zoom out and look at the full context, a much clearer picture emerges:

Foreclosure levels today are well within historical norms

Most homeowners are protected by record levels of equity

There is no data pointing to a wave of distressed sales or a market crash

In short, rising foreclosure headlines don’t equal a housing crisis.

Foreclosure Filings Are Up — But Context Changes Everything

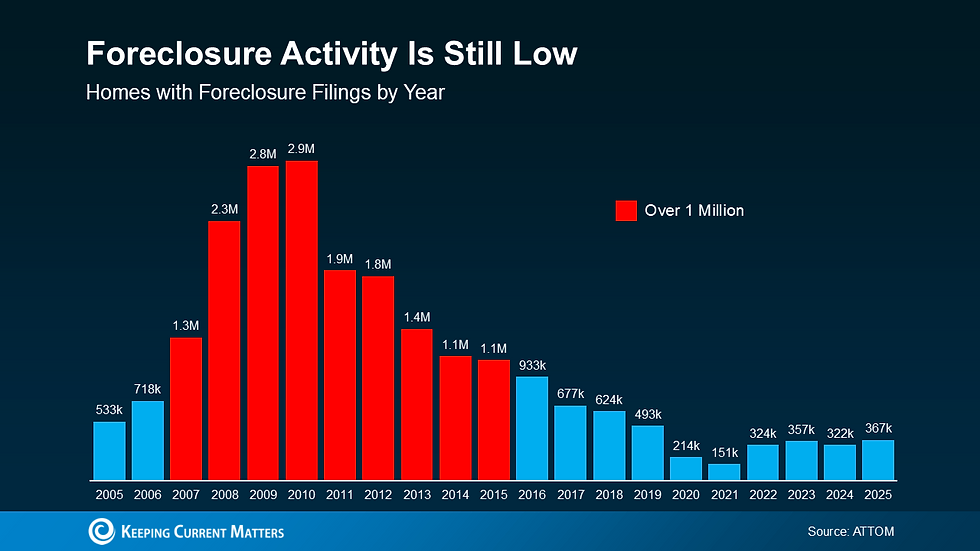

According to ATTOM data, foreclosure filings are up 32% year-over-year. That number grabs attention, and understandably so. For many people, it immediately brings back memories of 2008.

But this market is fundamentally different.

During the last housing crash, foreclosure filings surged past 1 million per year, driven by risky lending practices and an oversupply of homes. Today’s numbers are nowhere near those levels — not even close.

What we’re seeing now isn’t a return to crisis. It’s a return to normal.

When you compare current foreclosure activity to the years just before the pandemic (2017–2019), today’s levels are simply aligning with what’s historically typical for a healthy housing market.

This Is Market Normalization — Not Market Distress

Rob Barber, CEO of ATTOM, explains it clearly:

“Foreclosure activity increased in 2025, reflecting a continued normalization of the housing market following several years of historically low levels. While filings rose compared to 2024, foreclosure activity remains well below pre-pandemic norms and a fraction of what we saw during the last housing crisis.”

That word — normalization — matters.

After years of unusually low foreclosure activity, a modest increase doesn’t signal distress. It signals recalibration. While some homeowners are feeling financial pressure, this is not a flood of distressed properties hitting the market.

Why This Market Isn’t a Repeat of 2008

The fear surrounding foreclosures is rooted in the last crash — but the conditions today are very different:

Lending standards are far stricter

Borrowers are more qualified

Homeowners hold significantly more equity

Home prices have risen sharply over the past five years, leaving most homeowners with a strong financial cushion. That equity gives people options.

Instead of facing foreclosure, many homeowners can sell their property — often at a profit — if financial hardship arises. That’s a stark contrast to 2008, when millions owed more than their homes were worth.

Yes, foreclosure activity is increasing. But it’s still well within normal ranges and nowhere near past danger levels. The headlines may sound scary, but they’re missing critical context.

That’s why having a trusted real estate expert matters.

If you hear something in the news or on social media that raises concerns about housing, don’t rely on headlines alone. Talk to a local professional who can explain what’s actually happening — and how it impacts you, if at all.

If you want, I can also:

Shorten this for a blog post

Turn it into a carousel or reel script

Rewrite it in a more conversational or sales-focused tone

Comments